#936: Ten Trillion Here, Twenty Trillion There #🟦

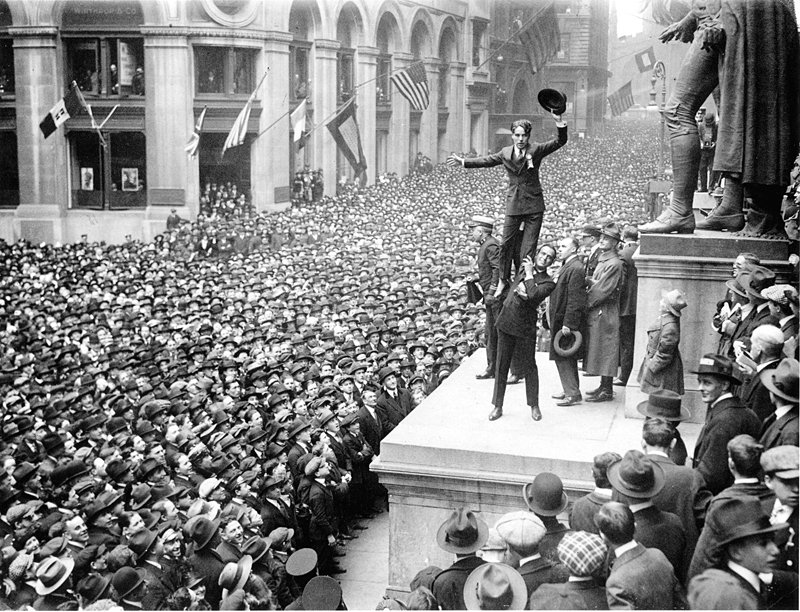

Fairbanks & Chaplin: 1918 Wall Street Bond Rally

Mark Twain, that most notable and quotable of all American authors once wrote “Never put off till tomorrow what you can do the day after tomorrow.” Because, so far as I know, he wasn’t referring to any contemporary situation in particular, his aphorism is thus both brilliant and timeless; it speaks to human nature in general.

In reflecting on how little time remains until the United States - for the first times in its history - defaults on its debt obligations . . . which, as of this past January, stood at $31.38 trillion and rising . . . Twain’s remark seems all the more tailor-made.

Trying to access blame – to determine precisely which side shoulders the greater burden in the nation’s titanic debt obligations – brings to mind yet another writer of renown: the occasionally controversial cartoonist Walt Kelly. Kelly (1913-1973) put into the mouth of Okefenokee Swamp-dwelling oposum Pogo, his greatest creation, the immortal words “We have met the enemy and he is us!” (n.b. This is an abridgement of what Master Commandant Oliver Hazard Perry announced at the Battle of Lake Erie, when his small naval force had defeated the British in 1813: "We have met the enemy and he is ours.")

In other words, Democrats and Republicans alike share a mutual blame for America’s massive debt; it’s just that the former are more “tax-and-spend,” the latter “cut-taxes-and-spend.” With America's Debt Ceiling about to be breached (it’s already been reached) by June 1, President Biden and Speaker Kevin McCarthy are about to sit down and see if anything can be done. POTUS wants a “clean bill,” wherein Congress passes an increase in the ceiling without any attached budgetary strings. Period.

By contrast, House Speaker Kevin McCarthy's "Limit, Save, Grow Act" of 2023, as recently passed by the House, would require broad-based spending cuts totaling $4.5 trillion over the next decade. President Biden had said in no uncertain terms that he will refuse to sign the act into law; he spoke truth-to-power when he referred to it as "dead on arrival" in the Democratic-controlled Senate. Speaker McCarthy wants to tie any rise to a series of draconian spending cuts which would most likely affect the poorest among us: veterans, children relying on food-stamps, students being crushed by debts, Medicaid Recipients, etc. Moreover this act mandates dramatic cuts in monies already allocated for such things as climate change programs and the addition of 78,000 new IRS agents . . . whose purpose is to make sure that millionaires and billionaires are paying their fair share.

Can you say “stalemate?”

The United States started running up debt long before July 4, 1776. Someone had to help pay for General Washington’s troops and the creation of the Continental Congress. The Revolutionary War was, to a great degree, financed through the selling of “Continentals bills of exchange,” arranged for by one Hayim Salomon, a Polish-born Jewish businessman living in Philadelphia. Salomon (1740-85) risked his growing fortune to travel to Europe and broker these bills of exchange at rock bottom prices. For his services, Salomon - who also made interest-free loans to many of the Founding Fathers and himself died a pauper at age 46 - charged a measly one-quarter-of-one-percent. (BTW: In 1941, Howard Fast wrote an impressive historical novel about Salomon, called Hayim Salomon: Liberty’s Son. If you are interested, there are still copies available . . . )

From 1776 to the turn of the 20th century, the Treasury Department had to go to get Congress’ approval whenever it needed to engage in deficit spending. Then, in the early 20th century, the debt limit was instituted so that the U.S. Treasury would not need to ask Congress for permission each time it had to issue debt to pay bills. During World War I, Congress passed the Second Liberty Bond Act of 1917 to give the Treasury more flexibility to issue debt and manage federal finances. All over the country, people gathered to buy tens of millions of dollars worth of war bonds to help finance the Great War. The most famous such gathering was on Wall Street, where movie stars Douglas Fairbanks, Charles Chaplin, Mary Pickford and Marie Dressler, along with then Assistant Secretary of the Navy Franklin D. Roosevelt, reached out to an estimated 20,000 people crowded into Wall Street, doing their best to get them to buy, buy, buy, lend, lend, lend. Within two hours, the assemblage bought more than $3,000,000 worth of bonds. (The actuality at the top of this article is a photo of that historic event.) Similar rallies would occur all around the country.

The first debt limit was instituted by Congress in 1939. Congress consolidated limits on specific forms of debt (e.g., separate caps on bonds and shorter-term debt) into one aggregate debt limit. The first federal debt limit was set at $45 billion and gave the Treasury Department wide discretion over what borrowing instruments to use, so long as total debt did not exceed that level. From then until now, Congress has raised the debt ceiling with every passing war (whether Congressionally mandated or not) and crisis. During the 4 years of the Trump administration, the president and Congress increased America’s debt limit by nearly 25%, due in part to an unprecedented tax cut which he sold to both Congress and the American public by claiming that it would pay for itself by greatly increasing Gross Domestic Product (GDP) by up to 6% per annum. He was wrong.

Indeed, raising the debt ceiling used to be most commonplace, least dramatic event of a congressional session. Why even during the Trump years, Congress increased the nation’ ability to borrow on 3 separate occasions. In matter of fact, when asked about threatening spending cuts in exchange for raising the debt ceiling, he told reporters “I cant think of anyone using the debt ceiling as a negotiating wedge.” (Someone should have asked a follow-up question, like “Mr. President, can you explain to us precisely what the ‘debt ceiling’ is? Come to think of it, of all 46 presidents in American history, he likely knows more about debt than any of his colleagues . . . real estate empires are, after all, colossi of debt.)

Speaker McCarthy’s insistence that the House will never accept a “clean” bill unless the White House accepts massive spending cuts is, in the words of President Biden, “D.O.A.” . . . “Dead On Arrival.” The MAGA branch of the House appears to believe that they can actually sell the American public on this toxic witches’ brew. How is that possible? Don’t they know that raising the debt limit has virtually nothing - NOTHING - to do with future spending? That cutting spending from the next budget will have no effect - NONE, NADA, GORNISHT - on what we have already committed ourselves to spending? Or, even worse, don’t they really care? Are they more interested in winning the next election - even if it means seeing the American economy go up in smoke, thus triggering the loss of millions of jobs, trillions of dollars of losses in people’s retirement savings, a major stock market crash and ensuing global depression? Are they looking to finish that which January 6, 2021 began . . . the overthrowing of the government? Nothing provides greater fodder for revolution than economic uncertainty and collapse. But do remember, all fodder is, when one puts it under a microscope, nothing more than manure.

$1,000,000,000,000,000.00!

To be certain, there are a couple of bizarre, dystopian suggestions on the horizon. Some economists (none I trust) have stated it's time for a break-the-glass option: a trillion-dollar coin. The coin — which wouldn't need to be bigger than an average coin, and can be made quickly — as part of a potential debt-ceiling loophole. The Treasury Department can mint platinum coins of any denomination. That's led to a school of thought that says Secretary Yellen should simply mint a trillion-dollar platinum coin and deposit it to pay off the debts until a more permanent solution can be found. Even conservative economists have found the notion to be “beyond silly.” The first problem, of course, is that it would have to get past Treasury Secretary Yellin; the second that the courts would, in all likelihood, shoot it down. But this is precisely the kind of simple-mindedness that MAGA Republicans believe they can sell their base on . . . even if they themselves know it is twaddle.

Then, there is a theory being discussed behind closed doors at the White House ,that the government would be required by the 14th Amendment to continue issuing new debt to pay bondholders, Social Security recipients, government employees and others, even if Congress fails to lift the limit before the so-called X-date. This theory rests on the 14th Amendment clause stating that “the validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned.”

Some legal scholars contend that this language overrides the statutory borrowing limit, which currently caps federal debt at $31.4 trillion and requires congressional approval to raise or lift. Top economic and legal officials at the White House, the Treasury Department and the Justice Department have made that theory a subject of intense and unresolved debate in recent months, according to several people familiar with the discussions.

It is unclear whether President Biden would support such a move, which would have serious ramifications for the economy and almost undoubtedly elicit legal challenges from Republicans. Continuing to issue debt in that situation would avoid an immediate disruption in consumer demand by maintaining government payments, but borrowing costs are likely to soar, at least temporarily.

Oh how I wish I had paid better attention to Dr. Daniel Suits’ class in “The Politics of Economics” 50+ years ago! All I know at this point in time is that playing “Debt Chicken” is an incredibly dangerous, economically lethal, game.

As of today, all I can hear is Ella Fitzgerald singing “Something’s Gotta Give.” Where oh where are the adults? There’s far, far more to politics than winning another term . . . or the White House, or taking back the Senate. Whatever happened to doing the right thing for the nation?

To paraphrase the late Senator Everett Dirksen (after whom a senate office building is named): “A trillion here, a trillion there, and pretty soon you’re talking real money.”

Copyright©2023 Kurt F. Stone #🟦